Introduction: Why is Paying Bills Important?

Paying your utility bills (like electricity, gas, water, and broadband) on time is super important for a few reasons:

You keep your services: If you don’t pay, your services could be disconnected, and you don’t want to be without heating or Wi-Fi!

Avoid extra charges: Late payment fees can add up, making things more expensive.

Build a good financial history: This is crucial for things like getting a phone contract, renting a flat in the future, or even getting a mortgage down the line. It shows you’re reliable.

Peace of mind: Once it’s paid, you don’t have to worry about it!

Let’s get started!

Step 1: Understand Your Bill

Before you do anything, you need to understand what you’re paying for.

Find your bill: Utility companies usually send bills monthly or quarterly (every three months). They can arrive by post (a physical letter) or by email if you’ve opted for paperless billing.

Tip: If you haven’t received a bill, check your junk/spam folder in your email, or contact your utility provider directly. They can usually resend it or tell you how to access it online.

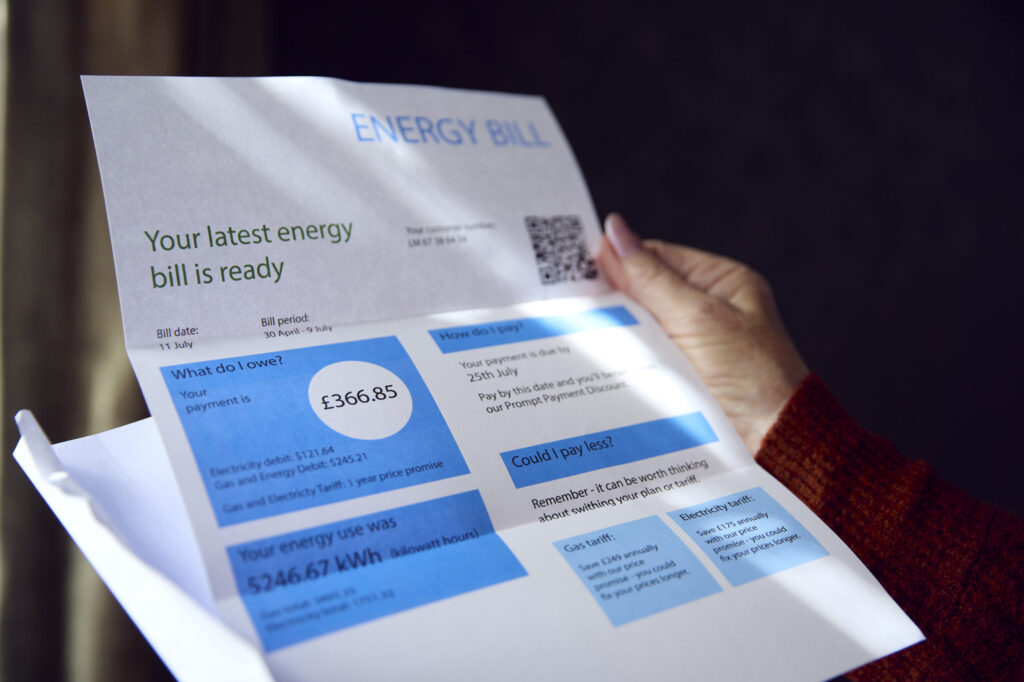

Locate Key Information: Look for these important details on your bill. They are usually highlighted or in bold:

Your Name and Address: Make sure these are correct.

Account Number / Customer Reference Number: This is a unique number that identifies you to the utility company. You’ll almost always need this when making a payment or contacting them. Keep it safe!

Bill Date: When the bill was issued.

Payment Due Date: This is the most critical date! It’s the last day you can pay without potentially incurring late fees or other issues. Circle this date, mark it in your calendar, or set a reminder on your phone.

Amount Due: How much you need to pay. It might be clearly labelled as “Total Amount Due,” “Balance,” or “Please Pay.”

Billing Period: The dates for which you are being charged (e.g., “1st June – 30th June”).

Usage Information: For electricity and gas, this will show how many units of energy you’ve used (usually in kWh – kilowatt-hours). It will also state if the reading was “Actual” (meaning you or the company took a meter reading) or “Estimated” (meaning they guessed your usage). If it’s estimated, consider providing an actual meter reading to get a more accurate bill next time.

Unit Rates & Standing Charge: This shows how much you pay per unit of energy and a daily fixed charge you pay regardless of how much you use.

Where to find contact details: Your utility company’s phone number, website, and sometimes their bank details for transfers will be on the bill.

Step 2: Choose How You’ll Pay

There are several ways to pay a utility bill in the UK. Choose the one that feels most comfortable and convenient for you.

Option 1: Direct Debit (Recommended for most people)

What it is: This is where you give your bank permission for the utility company to automatically take the money directly from your bank account on a specific date each month.

Pros:

Easiest: You set it up once, and payments happen automatically – no need to remember.

Often Cheaper: Many utility companies offer a discount if you pay by Direct Debit.

Predictable: You usually pay a fixed amount each month, which helps with budgeting, even if your usage varies. Your account balance will adjust over time, building credit in summer to cover higher winter usage.

Cons:

You need enough money in your account on the payment date, otherwise, you could incur bank charges for failed payments.

How to set it up:

Online: Log into your online account on the utility company’s website. Look for “Manage Payments” or “Set up Direct Debit.”

Over the Phone: Call your utility provider’s customer service number (found on your bill or their website). Tell them you want to set up a Direct Debit. They will ask for your bank account number and sort code (these are on your debit card or bank statement).

Bank: Sometimes you can set it up through your bank’s online banking or by visiting a branch. You’ll need the utility company’s name and their Direct Debit details.

Option 2: Online Payment (Debit/Credit Card)

What it is: You pay the bill manually each time using your debit or credit card on the utility company’s website.

Pros:

Control: You decide exactly when to pay (as long as it’s by the due date).

Instant: Payments are usually processed immediately.

Cons:

You have to remember to do it each time you get a bill.

Might be slightly more expensive than Direct Debit (no discount).

How to do it:

Go to the utility company’s website: Look for a “Pay Bill,” “Make a Payment,” or “My Account” section.

Enter your details: You’ll usually need your account number and the amount you want to pay.

Enter your card details: This is like buying something online.

Confirm payment: You’ll get a confirmation message or email. Keep this as proof of payment.

Option 3: Phone Payment (Automated or with an Advisor)

What it is: You call an automated payment line or speak to a customer service advisor to pay using your debit or credit card.

Pros:

Convenient if you don’t have internet access or prefer speaking to someone.

Cons:

Can sometimes involve waiting on hold.

How to do it:

Find the payment line number: This is usually on your bill.

Have your account number and card ready: Follow the automated instructions or tell the advisor your details.

Option 4: In Person (Cash or Card)

What it is: Paying with cash or card at a physical location.

Pros:

Good if you prefer cash or don’t have a bank account set up for online payments.

Cons:

Requires you to go somewhere.

How to do it in Leeds:

Post Office: Many Post Office branches in Leeds accept bill payments. Take your bill with the barcode or a payment card (if your utility company sent you one) to the counter. The staff will scan it and you can pay with cash or card.

Find your nearest Post Office: You can use the Post Office website’s branch finder or Google Maps. Examples include Leeds City Centre Post Office on Park Row or smaller branches in local areas like Headingley, Seacroft, or Morley.

PayPoint / Payzone: These are payment services often found in local convenience stores, newsagents, or supermarkets across Leeds. Look for the distinctive PayPoint or Payzone signs. Again, take your bill with the barcode to the shop assistant.

Find your nearest PayPoint/Payzone: Use the PayPoint or Payzone website’s store locator, or simply look out for the signs in local shops. There are hundreds across Leeds.

Your Bank: If you have an account with a high street bank, you can sometimes pay utility bills at their branch counter. Take your bill with you. Be aware that some banks might charge a small fee for this service if it’s not your own bank.

Option 5: Bank Transfer / Standing Order

What it is:

Bank Transfer (Ad-hoc): You manually send the money from your bank account to the utility company’s bank account each time a bill is due.

Standing Order (Regular fixed payment): You set up a regular, fixed payment to be sent from your bank account to the utility company’s bank account. This is less common for variable utility bills, but might be an option if you’ve agreed a fixed payment plan with your provider.

Pros:

Can be done online or via your banking app.

Cons:

You need the utility company’s bank account number and sort code (found on your bill or their website).

For ad-hoc transfers, you have to remember to do it each time.

How to do it:

Log into your online banking or app.

Go to “Payments” or “Transfers.”

Set up a new payee: Enter the utility company’s name, their bank account number, and sort code.

Important: Always include your account number/customer reference number in the “Reference” or “Description” box so they know the payment is from you.

Step 3: Confirm Your Payment

Once you’ve made a payment, it’s a good idea to confirm it:

Get a receipt: If paying in person, always ask for a receipt. Keep it safe!

Check your bank statement: After a few days, check your bank statement (online or physical) to make sure the payment has gone out.

Check your online utility account: Most utility companies will update your online account to show the payment has been received.

Step 4: Keep Records

It’s really helpful to keep a record of your bills and payments.

Physical Bills: Keep them in a file or folder.

Email Bills: Create a specific folder in your email for “Utility Bills.”

Payment Confirmations: Save any confirmation emails or receipts.

Spreadsheet/Notebook: You might want to create a simple spreadsheet or use a notebook to track when each bill is due, the amount, and when you paid it.

What if You Can’t Pay Your Bill (Support in Leeds)

It can happen to anyone, especially when you’re starting out. DO NOT ignore your bills. The most important thing is to act quickly and communicate.

Contact your Personal Advisor (PA) / Leeds City Council Leaving Care Team:

Your PA is your first point of contact for any financial worries or questions. They are there to support you.

Leeds City Council Leaving Care Service:

Phone: 0113 378 6771

Email: careleavers@leeds.gov.uk

Emergency / Out of hours: 0113 535 0600

They can offer advice, help with budgeting, and may even be able to provide some financial support or grants (like the Household Support Fund) if you’re really struggling. They can also connect you to other services.

The Archway Hub is the home of the Care Leaver Service in Leeds, and you are welcome to visit when it’s open if you prefer to speak in person.

Contact the Utility Company Immediately:

Explain your situation. They might be able to offer a payment plan, extend the due date, or put you on a hardship tariff. Don’t be afraid to explain you’re a care leaver and new to managing bills.

Get Free Debt Advice:

Citizens Advice Leeds: They offer free, independent, and confidential advice on debt, benefits, and budgeting.

Website: citizensadvice.org.uk/local/leeds/ (search for your nearest branch or advice by phone/webchat)

Main Contact: You can find details for various Leeds branches on their website, for example, Citizens Advice Leeds on Merrion Street.

National Debtline: Offers free, confidential debt advice over the phone and online.

Phone: 0808 808 4000

Website: nationaldebtline.org

StepChange Debt Charity: Provides free debt advice and solutions.

Phone: 0800 138 1111

Website: stepchange.org

Check for Grants and Benefits:

Your PA can help you check if you’re eligible for Universal Credit, Housing Benefit, or other benefits that can help with living costs.

Organisations like Turn2Us and The Rees Foundation provide grants for care leavers who are struggling financially. Your PA can help you apply.

Leeds City Council’s “Financial support for care leavers” page (leeds.gov.uk/children-and-families/leaving-care/financial-support) is a great resource, confirming that your PA can help with budget plans, benefit problems, and even help with food parcels or energy bills in difficult situations.

Become Charity: Offers a free Care Advice Line (0800 023 2033) for care-experienced young people, offering support with financial crisis, benefits, and grants.

Important Reminders:

Don’t ignore bills: They won’t go away, and problems get worse if you do.

Ask for help: There are people and services in Leeds specifically there to support care leavers. You are not alone!

Budgeting: Try to set aside money for your bills as soon as you get paid. A simple budget plan can make a huge difference. Your PA can help you create one.

Meter Readings: Regularly submit actual meter readings to your electricity and gas provider to ensure your bills are accurate and you’re not paying too much (or too little, leading to a big bill later!).

Paying bills is a key part of living independently. It might feel a bit overwhelming at first, but with these steps and the support available in Leeds, you’ll soon get the hang of it! You’ve got this.